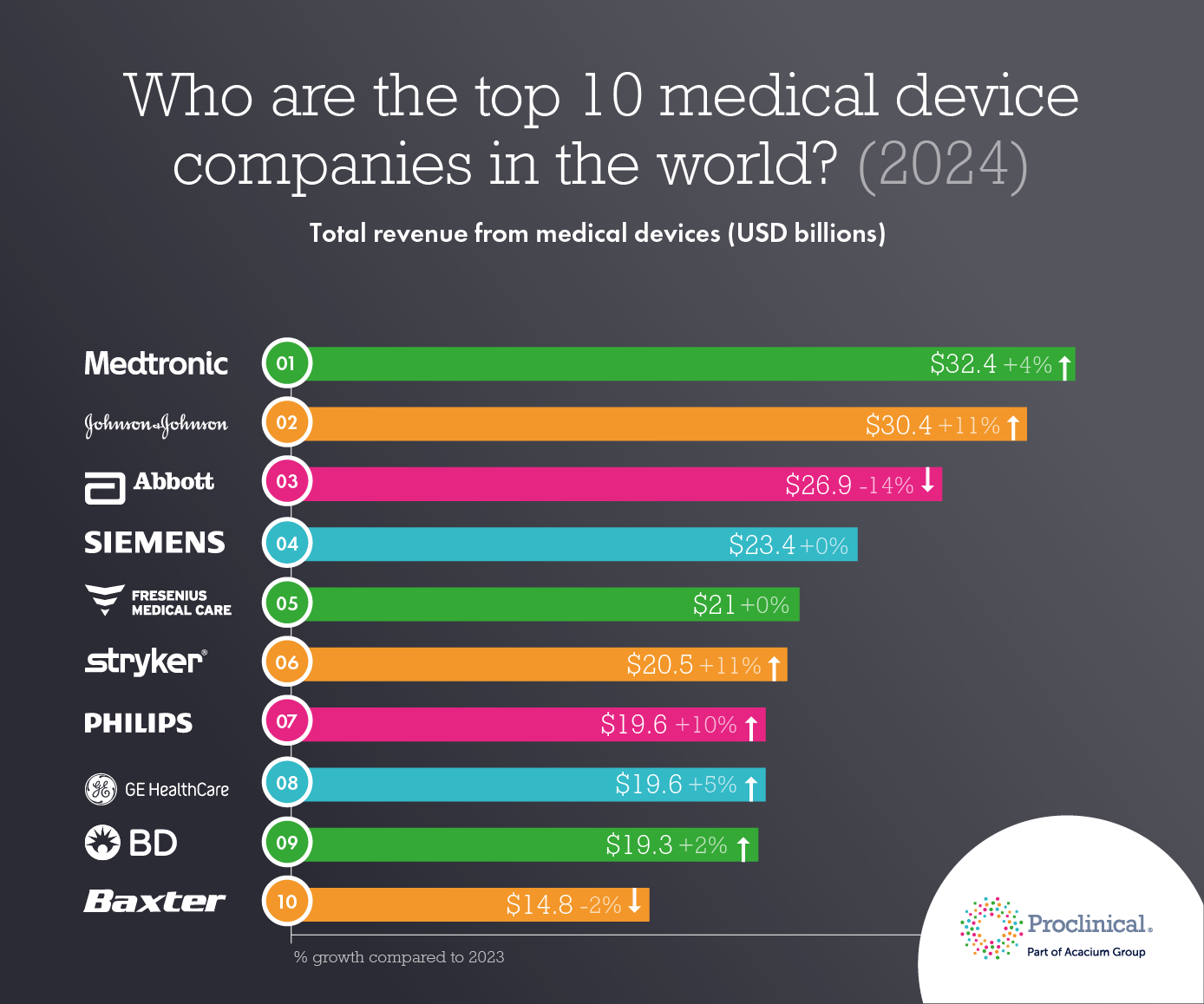

Who are the top 10 medical device companies in the world in 2024?

The global medical devices market was valued at $518 billion in 2023, and is projected to reach nearly $886 billion by 2030.

The rising prevalence of chronic diseases, coupled with an increase in surgical and diagnostic procedures, is driving significant growth. This surge is pushing companies to enhance, innovate, and create groundbreaking medical advancements at an exciting pace.

In the list below, we have ranked the leading medical device companies by their 2023 revenue, looking at their medical devices segment results only.

10. Baxter

US$14.8 (-2%)

In tenth spot we have Baxter. For almost a century, Baxter have pioneered significant medical innovations that changed healthcare and are leaders in producing nutritional, renal and surgical care equipment.

In 2022 the company recorded impressive growth of 18% with sales amounting to US$15.1 billion, in 2023 sales slowed and reached US$14.8 billion, marking flat growth. The company received nearly half of their sales from the US, which brought in $7bn.

Looking ahead, Baxter is well positioned to advance its key strategic priorities in line with its mission to “Save and Sustain Lives”. As of the end of the third quarter of 2023, the company completed the divestiture of its BPS business, further sharpening its strategic focus in alignment with the transformational initiatives set at the beginning of the year.

9. Becton Dickinson & Company

US$19.3 (+2%)

A staple to the top 10 is the pioneering global medical technology company, Beckton Dickinson & Company. Commonly referred to as BD, Beckton Dickinson & Company is an American multinational that manufactures and sells medical devices, instrument systems, and reagents.

After the spin off its Diabetes Care business, now known as Embecta Corp, BD had a tough 2022, but, in 2023 things started to look up for the company. Full year 2023 revenues reached $19.3 billion marking an increase of 2%. The company’s growth was broad-based across its segments, with BD Medical, BD Life Sciences, and BD Interventional all reporting a rise in revenues. Both the US and International markets contributed to this positive trend, with revenue growth of 6.3% and 7.6%, respectively.

In a press release, Tom Polen, chairman, CEO and president of BD said, "We achieved another quarter, and another year, of strong performance through our talented team's execution of our BD2025 strategy and differentiated portfolio of medical technologies that are increasing healthcare efficiency and improving the lives of patients around the world”, he went on to add, "Looking ahead, continued execution of our category leadership strategy in higher-growth markets, advancement of our strong innovation pipeline and delivery against our simplification programs position us well to deliver durable growth in fiscal 2024 and beyond."

8. GE HealthCare

US$19.6 (+5%)

In 8th position on our list of top medical device companies is GE Healthcare, a leading global medical technology and life sciences company. With a diverse portfolio that includes imaging, ultrasound, software, and life care solutions, GE Healthcare has been serving patients and providers for over 100 years. The company is committed to advancing personalised, connected, and compassionate care.

In November 2021, the company announced a strategic demerger into three investment-grade public entities, with GE HealthCare as one of the key divestitures. The spin-off was successfully completed in January 2023, and the company achieved impressive full-year revenues of $19.6 billion, primarily driven by sales in Imaging and Ultrasound. In a significant move for 2023, GE HealthCare revealed its plans to acquire AI medtech manufacturer Caption Health for an undisclosed amount. Continuing this momentum, in mid-2024, the company announced another agreement to acquire the clinical artificial intelligence business from Intelligent Ultrasound, further enhancing its portfolio of AI-enabled devices. This acquisition supports GE HealthCare's precision care strategy, aiming to address inefficiencies and elevate the quality of patient care.

In a company press release, GE HealthCare President and CEO Peter Arduini said, “After our first year as a publicly traded company, I’m pleased to announce robust fourth quarter and full year results. This strong financial performance is a testament to our dedicated team and successful execution of our precision care strategy. We’ve made significant strides, including investing over $1 billion in R&D for future growth, helping drive more than 40 innovations in 2023.”

7. Philips

US$19.6 (+10%)

Philips, a diversified technology leader with over a century in business, has made a remarkable climb into 7th place. Its healthcare division, which accounts for 42% of global revenue, spans three key areas: Diagnosis & Treatment, Connected Care, and Personal Health.

After a challenging 2022, marked by operational and supply chain setbacks, Philips made a comeback in 2023 with the launch of a three-year plan aimed at delivering sustainable impact. In just the first year of this strategy, the company achieved an impressive 10% growth in 2023, signalling a strong rebound and renewed momentum.

In light of the company’s full year results, CEO Roy Jakobs expressed, “We saw strong growth throughout the year based on the actions we have taken to improve supply chain reliability and simplify our organization” he went on to add, “ We continue to partner with many healthcare systems around the world, supporting them to become more efficient, and addressing their resourcing and productivity challenges with our AI-powered innovations. This includes our newly launched next-generation ultrasound systems, and our unique mobile MRI system with helium-free operations. We are confident in our plan to help consumers lead healthy lives and healthcare providers deliver efficient, high-quality care to patients in a sustainable way. Based on our ongoing actions to enhance execution, we expect further performance improvement in 2024.”

6. Stryker

US$20.5 (+11%)

Founded in 1941, American multinational Stryker has grown into one of the world's leading medical technology companies. With over 50,000 employees worldwide, Stryker focuses on creating innovative solutions in orthopaedics, medical and surgical solutions, neurotechnology and spinal care that help improve patients’ conditions and hospital outcomes.

In 2023, Stryker’s full year revenues surpassed US$20 billion for the first time in the company’s history, marking an increase of 11% year on year. This milestone was driven by robust performance across all divisions, with MedSurg and Neurotechnology leading the charge with an impressive 12.3% growth. The surge was fuelled by heightened demand for medical products, particularly in emergency care and acute services, cementing Stryker's position as a global force in the medical technology landscape.

In the earnings call, Mr. Kevin Lobo, Chair and Chief Executive Officer commented, “First, I want to recognize and celebrate our achievement of surpassing $20 billion in sales. We continue to be a high-growth company with a focus on our mission to deliver for our patients and customers”, he went on to add, “I am very excited about our future. We are in a strong position with robust demand across both procedures and capital, easing macro constraints and a strong pipeline of innovation. I want to thank our over 50,000 employees for their unrelenting determination, agility and performance.”

5. Fresenius Medical Care

US$21.0 (0%)

German-based international healthcare company Fresenius takes the 6th spot in 2024. Through Fresenius Medical Care, the company remains the world's leading provider of products and services for individuals with kidney diseases, serving nearly 4 million patients who rely on regular dialysis treatment across the globe. While sales in 2023 remained relatively flat compared to 2022, at €19.45 billion they rose by 5% on a constant currency basis, driven by favourable business developments across its core sectors.

Helen Giza, Chief Executive Officer of Fresenius Medical Care, said: “In 2023, we delivered on our commitments while we fundamentally transformed Fresenius Medical Care. Exceeding our upgraded financial outlook for the full year was the very successful finish to an extraordinary year. We implemented the new global operating model, progressed on our operational turnaround ambitions, changed our legal form and advanced on the Portfolio Optimization Program through key divestments. Thanks to the commitment of our 120,000 employees, the high quality of care for our patients remains front and center in everything we do. Based on the turnaround progress achieved last year, we have a strong foundation to build on to make 2024 a year of accelerated.”

4. Siemens Healthineers

US$23.4 (0%)

Headquartered in Germany, Siemens Healthineers—the medical technology division of the automation and electrics giant Siemens—holds the fourth spot on the list. In 2023, the company saw flat growth, primarily due to a drop in demand for Covid-19 antigen tests. However, excluding antigen tests, revenues increased by 8.3%, reflecting solid performance and a growing market share across imaging, diagnostics, Varian, and advanced therapies, with new innovations introduced in each segment.

In a strategic masterstroke announced in August 2024, Siemens Healthineers revealed a bold €200 million (US$224 million) acquisition of the diagnostic arm of Advanced Accelerator Applications, a division of global healthcare giant Novartis. This move positions the company to dominate Europe’s PET radiopharmaceutical market, expanding its influence from the US to a broader international stage.

3. Abbott

US$26.9 BN (-14%)

The global no.1 in 2023, Abbott drops into third place in 2024. With a workforce of over 115,000 employees, a presence in more than 160 countries, and over 135 years of innovation, Abbott continues to deliver breakthrough products across diagnostics, medical devices, nutrition, and branded generic pharmaceuticals.

In 2023, Abbott’s diagnostics and medical devices segment reported sales of $26.875 billion, marking a 14% decline driven by reduced demand for Covid-19 tests. However, the company's medical devices segment surged by 14% globally, powered by robust growth in Diabetes Care, Neuromodulation, Structural Heart, Electrophysiology, Heart Failure, and Rhythm Management. Several recently launched products and new indications, including Amplatzer, Amulet, Navitor, TriClip, and AVEIR, played a key role in this impressive performance.

Robert B. Ford, chairman and chief executive officer of Abbott commented, "The strength and diversity of the Abbott portfolio drove our success in 2023", he added, "With our highly productive pipeline, we're well-positioned for growth in 2024 and beyond."

2. Johnson & Johnson

US$30.4 BN (+11%)

Johnson & Johnson rises to second place in 2024, with its newly rebranded MedTech division driving the momentum. The MedTech segment offers a diverse portfolio of cutting-edge products spanning orthopaedics, surgery, interventional solutions, and eye health, reinforcing J&J’s leadership in the medical devices industry.

Following a period of flat sales for the company's MedTech division after the Covid-19 pandemic, FY 2023 marked a significant turnaround, with income surging by an impressive 11%. This growth was largely driven by the acquisition of Abiomed, which contributed 4.7% and has firmly positioned Johnson & Johnson as a key player in heart recovery solutions. Global adjusted operational sales saw a strong 7.8% growth, fuelled primarily by the success of electrophysiology products in Interventional Solutions, contact lenses in Vision, wound closure products in General Surgery, and Biosurgery Innovations in Advanced Surgery.

1. Medtronic

US$32.4 BN (+4%)

After losing the top spot for the first time in five years in 2023, Medtronic has made a powerful comeback in 2024, reclaiming its No. 1 position. With more than 95,000 people across 150 countries, the company provides solutions using technology, from AI to connected care and beyond to treat more than 70 health conditions, including diabetes, neurological, cardiovascular plus much more.

Medtronic posted impressive full-year global revenues of $32.4 billion, marking a solid 4% increase on a reported basis. Growth was driven by the company’s Cardiovascular portfolio (+2.7%), Neuroscience therapies (+5.0%) and Medical Surgical segment (+5.4%).

In a press release announcing the company results, Geoff Martha, Medtronic chairman and chief executive officer commented, "We delivered a strong finish to the fiscal year, with broad strength across our businesses and each of our four segments posting mid-single digit or higher organic revenue growth," he went on to say, "Our momentum is building into the new fiscal year. We're beginning new product cycles in some of MedTech's most attractive markets, which is further enhanced as we apply AI across our portfolio. We are very optimistic about what we can achieve in fiscal '25 and beyond."

IS YOUR MEDICAL DEVICE COMPANY AIMING TO GROW?

At Proclinical, we work with a number of leading global medical device companies. Our dedicated medical device recruitment team are specialists in sourcing skilled and experienced professionals to fill a wide variety of roles across all areas of medical devices, medical technology and digital health. Find out more about our range of workforce solutions and how we can help your business grow globally.

INTERESTED IN WORKING FOR ONE OF THE TOP MEDICAL DEVICE COMPANIES?

At Proclinical , we are specialists at recruiting for all types of medical device jobs. If you’re looking for a new position, simply use our job search tool to find the right role for you.

.png)

.png)

.png)

.png)

.png)

.png)